DISCLAIMER: THIS ARTICLE SHOULD NOT BE TAKEN AS FINANCIAL OR INVESTMENT ADVICE. ANY INFORMATION SHARED IN THIS ARTICLE IS PURELY FOR INFORMATIONAL PURPOSES.

In today’s competitive business landscape, companies are constantly seeking ways to improve efficiency, reduce costs, and enhance productivity. Collaborative robots, or cobots, have emerged as powerful tools for achieving these goals. Cobots work alongside human operators to automate tasks, increasing productivity and reducing errors. However, the acquisition costs of cobots can pose a significant hurdle for businesses. Fortunately, Section 179 of the IRS Tax Code provides a valuable opportunity to offset these expenses and accelerate the adoption of cobots within your operations.

What is Section 179?

Section 179 is a powerful tax deduction that allows businesses to deduct the full cost of qualifying equipment purchased and placed in service during the tax year. This deduction can significantly reduce the upfront costs associated with cobot implementation, making them more accessible and financially attractive.

Who is Eligible for Section 179?

Section 179 is available to businesses of all sizes, including corporations, partnerships, and sole proprietorships. AUBO Cobots qualify for the deduction, as purchased equipment must be must be:

- Tangible property

- Depreciable property

- Used property

How Can Businesses Use Section 179 to Purchase Cobots?

To use Section 179 to purchase cobots, businesses must meet the following criteria:

- The cobots must be purchased new to the business.

- The cobots must be placed in service during the tax year.

- The cobots must be used primarily for business purposes.

Example:

Let’s say a business purchases a $20,000 cobot in 2023 and places it in service during that year. The business can deduct the full $20,000 cost of the cobot from its taxable income in 2023.

Benefits of Using Section 179 to Purchase Cobots

There are several benefits to using Section 179 to purchase cobots:

- Reduces upfront costs: Section 179 can significantly reduce the upfront costs of purchasing cobots, making them more affordable for businesses.

- Increases cash flow: By reducing taxable income, Section 179 can free up cash flow that businesses can use for other purposes, such as investing in new equipment or hiring new employees.

- Encourages automation: Section 179 incentivizes businesses to invest in automation, which can lead to increased productivity, reduced errors, and improved safety.

How to Apply for Section 179 Deduction

Businesses can apply for the Section 179 deduction by filing Form 8948 with their tax return. The form requires businesses to provide information about the qualified equipment they purchased, including the date of purchase, cost, and depreciation method.

AUBO Robotics USA: Your Partner in Cobot Automation and Tax Savings

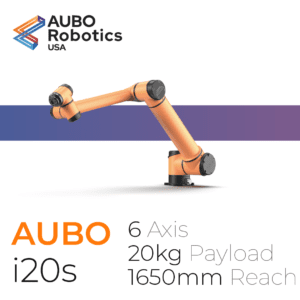

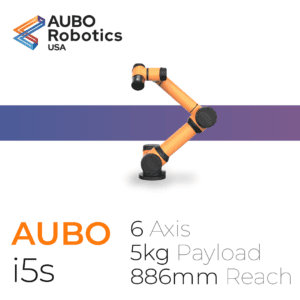

AUBO Robotics USA offers a comprehensive line of i-Series cobots that meet all Section 179 requirements, allowing you to reap the full benefits of this tax provision while revolutionizing your automation workflow. Our cobots are renowned for their precision, consistency, increased productivity, flexibility, ease of use, and safety features.

Contact AUBO Robotics USA today to learn more about our innovative cobots and how Section 179 can help you save money while automating with confidence.

In addition to the information above, here are some additional tips for businesses that are considering using Section 179 to purchase cobots:

- Consult with a tax advisor: A tax advisor can help you determine if you are eligible for the Section 179 deduction and can provide guidance on how to properly claim the deduction.

- Plan your purchases: Make sure to plan your purchases so that you can take advantage of the Section 179 deduction.

- Keep good records: Keep good records of your cobot purchases and depreciation so that you can substantiate your deduction if necessary.

By following these tips, businesses can maximize their savings under Section 179 and reap the many benefits of cobot automation.